Important Financial Statements for Small Business Bookkeeping – Infographic

Many small business owners stress over financial statement and focus on bookkeeping services more. However, it is often neglected or businesses try to hide it. But what happens next? You lose sight over your financial performance leading your business towards insolvency. Don’t forget, running a small business is challenging as it evolves with a high amount of risk. And neglecting the most crucial part of your business will surely allow IRS to knock your door. Without appropriate knowledge of financial statements, you cannot analyze the financial position of your business in the market, which will ultimately lead to poor budgeting, more expenses, more taxes, etc.

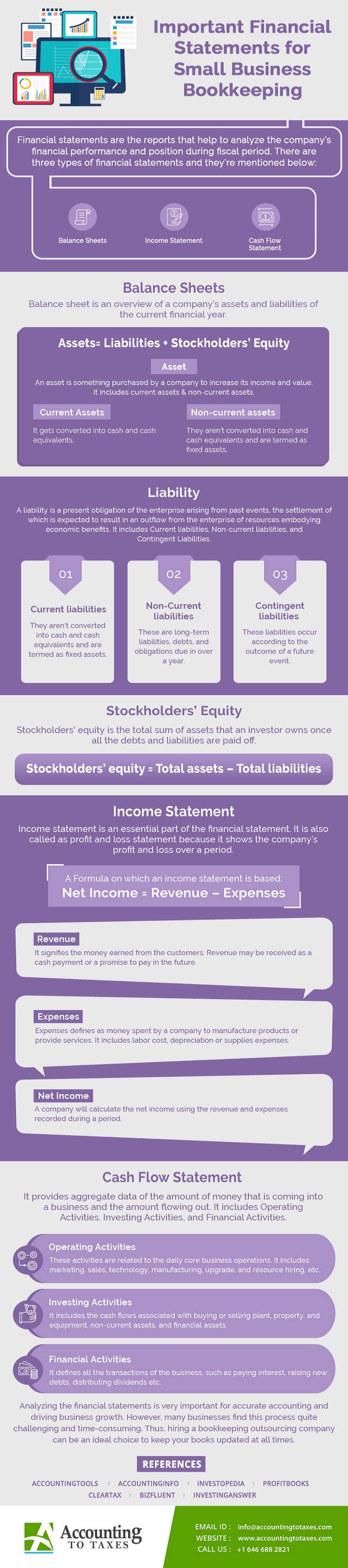

It is vital for every entrepreneur, irrespective of their business size to gain basic knowledge of analyzing their financial reports. Therefore, here in this Infographic, we’ve discussed financial reports that every small business owner should keep in mind and thoroughly analyze these reports to stay consistent in the market.

3 important financial statements for bookkeeping

1. Balance sheet:

A balance sheet is an overview of a company’s assets and liabilities of the current financial year.

2. Income statement:

An income statement is an essential part of the financial statement. It is also called as profit and loss statement because it shows the company’s profit and loss over a period.

3. Cash flow statement:

It provides aggregate data of the amount of money that is coming into a business and the amount flowing out. It includes Operating Activities, Investing Activities, and Financial Activities.

These financial statements are prepared with the right bookkeeping processes.