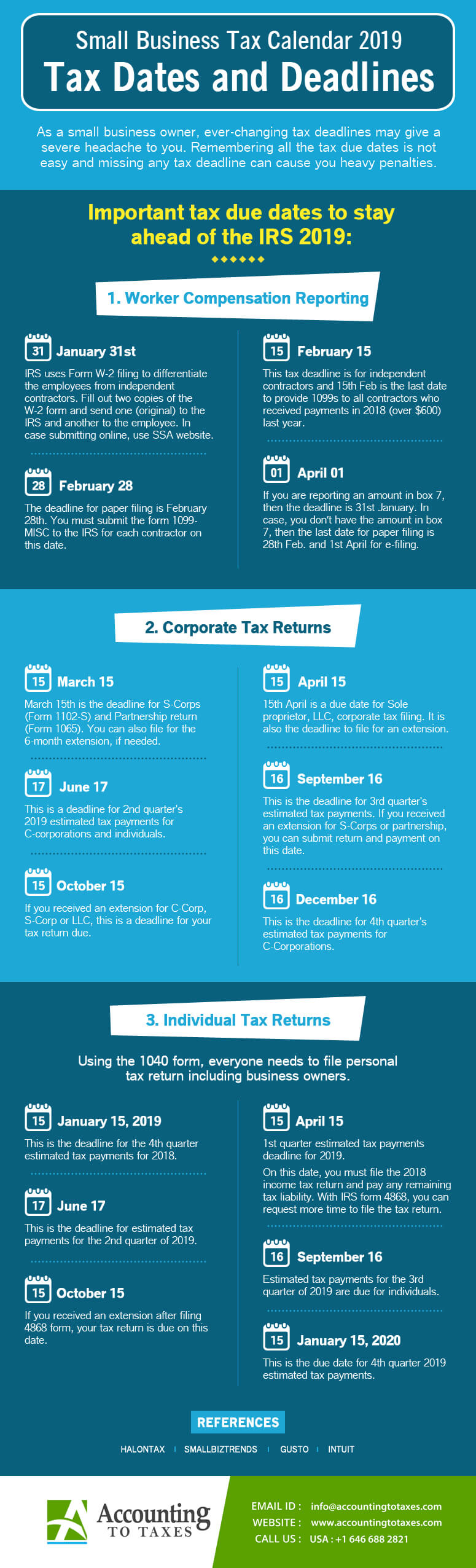

Small Business Tax Calendar 2019 – Tax Dates and Deadlines

Navigating the intricacies of tax obligations is a crucial aspect of managing a small business, and having a comprehensive understanding of the 2019 tax calendar is essential to ensure compliance with deadlines and avoid potential penalties. The 2019 tax calendar serves as a roadmap for small business owners, outlining key dates and deadlines throughout the year.

Businesses should mark significant dates, such as filing deadlines for quarterly estimated taxes, ensuring they allocate the necessary resources and documentation in a timely manner. The calendar also highlights important dates related to payroll tax deposits, providing businesses with a clear schedule for meeting their financial obligations to employees and government authorities.

One pivotal aspect of the 2019 tax calendar is the deadline for filing annual tax returns. Small businesses must be vigilant in preparing and submitting their returns by the specified date to avoid late-filing penalties. Additionally, the calendar emphasizes the deadlines for various tax credits and deductions, prompting businesses to stay informed about potential opportunities to minimize their tax liability. Properly leveraging these incentives can positively impact a small business’s bottom line.

Moreover, the calendar underscores the importance of staying organized throughout the year. By maintaining accurate and up-to-date financial records, businesses can navigate tax season more efficiently, reducing the risk of errors and ensuring a smoother filing process.

In essence, the tax calendar is not merely a chronological list of dates; it is a strategic tool that empowers small businesses to proactively manage their tax responsibilities. In conclusion, small business owners should view the 2019 tax calendar as a valuable resource, utilizing it to stay ahead of deadlines, optimize financial planning, and ultimately contribute to the long-term success of their enterprises.

2019 Tax Calendar for Small Businesses